JetBlue is a popular airline headquartered in the vibrant New York City. It is a familiar name to many travelers. For those who frequently fly, the JetBlue Mastercard offers an excellent opportunity to improve their travel experience with additional rewards. Selecting the right card for your preferences, you just need to wait for it to be delivered and then follow the steps below to activate your JetBlue Mastercard.

How to Activate JetBlue Mastercard?

Are you a new JetBlue Mastercard holder looking to activate your card? Follow these simple steps to activate it through the website at https://cards.barclaycardus.com/?p=jetblue.

- Step 1: Download the App

- Start by downloading the Credit Card app from the Apple App Store or Google Play, or visit the activation page at jetblue mastercard.com/activate.

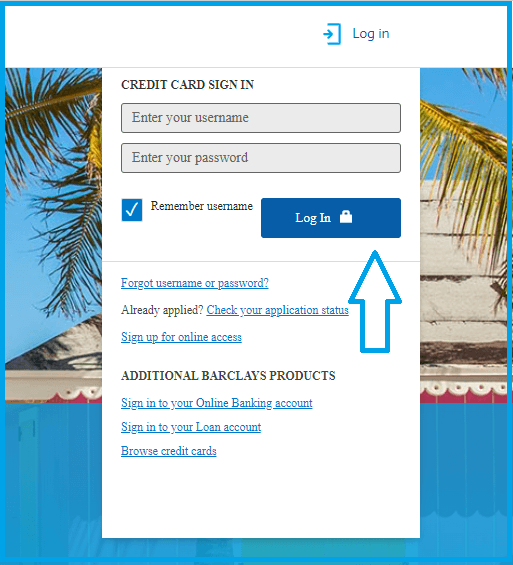

- Step 2: Sign In for Existing Cardholders

- If you have a Barclays account, choose "Existing Cardmember" on the app or website. Log in with your username and correct password, verify your identity, and your Mastercard will be activated.

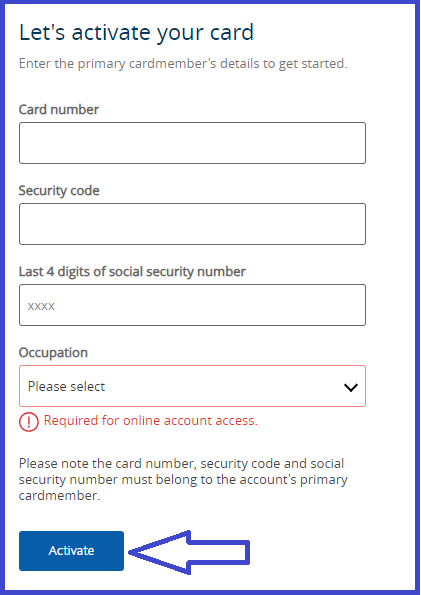

- Step 3: Create an Account for New Cardholders

- New cardholders or those without online access can select "Activate my card now." Fill in the required information securely for a new account setup.

- Step 4: Activate Your JetBlue Mastercard

- Click "Continue" after completing the fields, and your Mastercard will be swiftly activated. Now, you're ready to use your card for flights and enjoy exclusive benefits.

Activate JetBlue MasterCard by Customer Service:

If you prefer an alternative activation method or encounter issues with the online process for your JetBlue MasterCard, you can follow this straightforward procedure. Simply call the JetBlue MasterCard activation customer care number +1 (844) 720-1060 and communicate the problem to the representative. Furnish specific details about the jetblue mastercard/activate and other required information during the conversation. We have outlined the steps given below.

- Use your phone to call the provided toll-free number +1 (844) 720-1060.

- A service representative will answer, and you must share your needs with the JetBlueMasterCard customer service.

- You will be asked for your card details and necessary identification information.

- Provide the correct data, and the representative will handle the entire procedure in the backend. Stay patient during the full process.

- Lastly, the JetBlue MasterCard activation is complete.

Why choose JetBlue Master Cards?

Are you in search of an outstanding credit card offering incredible rewards and advantages? The JetBlue Credit Card might be the ideal choice for you. This card offers special perks such as earning points on all purchases and has no blackout dates for award flights. and even discounts on in-flight expenses. Continue reading to discover more about the fantastic advantages that come with owning a JetBlue Credit Card.

-

Earning Rewards on Purchases:

When you use your JetBlue Credit Card to buy things, you get points: three points for each dollar you spend on JetBlue flights, two points for every dollar at restaurants and grocery stores, and one point for every dollar elsewhere. If you book a JetBlue Vacations package, you get three extra points per dollar. You can earn as many points as you want, but they go away after 12 months.

-

Flexible Award Flight Bookings:

Owning a JetBlue Credit Card means freedom from blackout dates when redeeming points for award flights. Enjoy the flexibility to book any available flight at any time, irrespective of popularity or booking lead time.

-

Savings on In-Flight Expenses:

Make the most of your JetBlue Credit Card by receiving an automatic 20% discount on food and beverage purchases during flights. No need for coupons or codes – the discount is applied at checkout.

- Exclusive Access to Offers:

With a JetBlue Credit Card, access exclusive offers and promotions not accessible to the general public. These special deals may include discounts on flights, hotel accommodations, car rentals, cruises, and more.

-

Fee-Free International Transactions:

Travel worry-free with your JetBlue Credit Card, as there are no foreign transaction fees. Save money while using your card abroad, as you will not be charged any additional money for international transactions.

Different Types of JetBlue MasterCards:

Barclays offers a range of JetBlue MasterCards, each with unique benefits. These cards provide opportunities to earn points on JetBlue flights, dining, groceries, and other purchases, catering to various preferences and travel needs.

Blue World MasterCard

The Blue World MasterCard doesn't charge you anything every year, and you get a cool reward when you first get it. If you spend $1,000 in the first three months, you get 15,000 points! This card is great for getting points - you get 3 times the points for buying things from JetBlue, 2 times for groceries and dining, and 1 time for everything else you buy. So, if you want a card that gives you lots of different rewards and a nice bonus when you start, the Blue World MasterCard is a good choice.

JetBlue Plus World Elite MasterCard

The JetBlue Plus World Elite MasterCard has a $99 annual fee and a tempting signup bonus of 40,000 points when you spend $1,000 in the first three months. This card gives you awesome rewards: 6 times the points when you buy from JetBlue, 2 times the points on dining and groceries, and 1 time the points on all other purchases. Plus, you can get 5,000 bonus points each time you renew and pay the annual fee. This makes the JetBlue Plus World Elite MasterCard an attractive choice for travel and everyday spending enthusiasts..

World Elite Mastercard Benefits

Access over 2,000 luxury hotels worldwide with MasterCard Luxury Hotels & Resorts. Explore a variety of travel and lifestyle services through MasterCard, including private jets, cruise lines, savings on airfare, airport concierge, chauffeured cars, tours, car rentals, vacation packages, and more. Enjoy discounts with One Fine Stay. These perks create an attractive and all-encompassing package for those seeking diverse travel and lifestyle benefits.

JetBlue Rewards World Elite MasterCard:

If you used to have an Amex card, you can get the JetBlue Rewards World Elite MasterCard. It has a $40 yearly fee and gives you rewards like 4 times the points on JetBlue purchases, 2 times on dining and groceries, and 1 time on everything else you buy. There's also the JetBlue Business MasterCard available.

What are the advantages and disadvantages of JetBlue Mastercard?

The JetBlue MasterCard is a popular choice for people who want to get the most out of rewards and travel perks. It has a great rewards program, no yearly fees, and lots of extra benefits, making it a well-liked card. But before you decide if it is the right card for you, make sure to think about both the advantages and the disadvantages.

Advantages:

- Great rewards program: The JetBlue MasterCard provides a fantastic rewards program, letting cardholders earn 3X points on JetBlue purchases, double points on dining purchases, and 1X points on all other purchases. This can lead to substantial savings, and there is no limit on how many points you can earn.

- No yearly fee: A standout feature of the JetBlue MasterCard is its lack of an annual fee. This means you can use the card without worrying about paying extra fees each year.

- Travel perks: Cardholders can enjoy various travel benefits, including free checked bags, and no foreign transaction fees, discounted companion fares, . These perks can make your next trip more budget-friendly.

- Exclusive offers: Card Holders qualify for special deals and discounts, such as up to 30% off select car rentals and a 20% discount on JetBlue Vacations packages.

Disadvantages:

Be careful with interest: This Card has a high interest rate. It is important to pay off your balance every month to avoid extra charges.

- Limited flight options: With the JetBlue Rewards program, you can only use points for JetBlue flights and some specific partners. This means you have fewer choices for earning and using rewards.

- Not good customer service: Some people who have the card are not happy with the customer service. It seems they've had issues getting help with disputes or reward-related problems.

FAQS about JetBlue mastercard activations

Q1. What is a JetBlue Plus Card member?

The JetBlue Plus Card membership is made for people who fly with JetBlue a lot. If you only fly with JetBlue a few times a year, this card may not be for you.

Q2. Can I use my JetBlue Plus credit card immediately after activation?

No, you will not be able to use your JetBlue Plus Card right after approval. You need to wait for about 7-10 business days to get it in the mail. However, if you want it sooner, you can choose for expedited shipping, which comes with a $15 fee, and receive your card within 1-2 business days.

Q3. What Rewards Come With My JetBlue Card?

With your JetBlue Mastercard, you enjoy a variety of perks and rewards. You earn extra TrueBlue points when making purchases with JetBlue, at restaurants, and grocery stores. These accumulated points can be used to redeem flights with JetBlue or Hawaiian Airlines, as well as JetBlue package vacations.

Q4. Do JetBlue credit card points expire?

Points earned with the JetBlue credit card will remain valid indefinitely unless the cardholder decides to close their account.

Q5. Who manages JetBlue credit cards?

The JetBlue credit card is issued by Barclays Bank Delaware (Barclays) under a license granted by Mastercard International Incorporated.